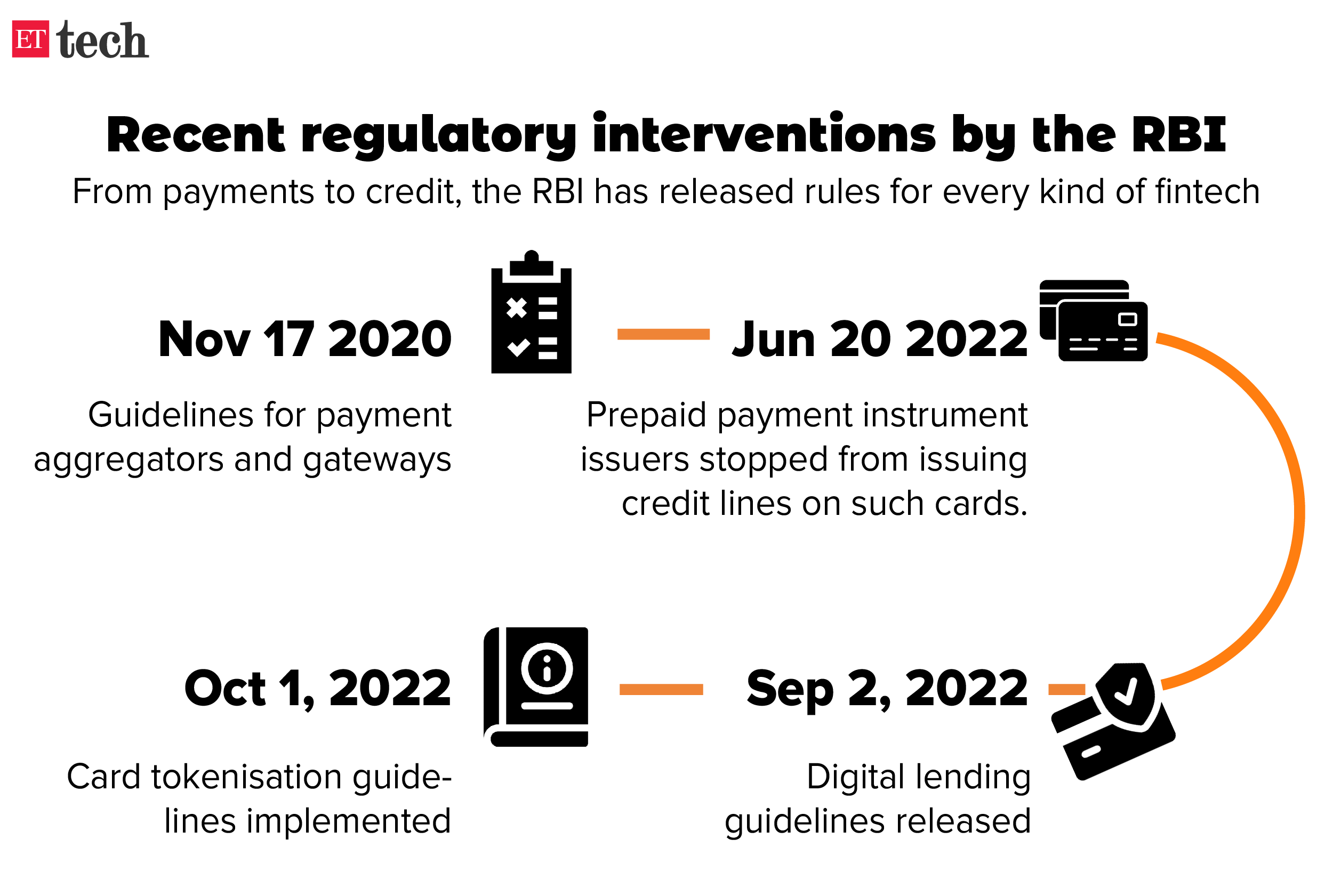

Hi, right here’s Pratik Bhakta in Bengaluru. Having lined fintechs and monetary sector regulators for many One year now, the sizzling piece stands out as being an inflection point for the repeatedly buzzy substitute. Whereas it is neatly-known that the freeze within the funding atmosphere is impacting challenge-backed startups, the fintech sector is bracing for the dual blows of a funding iciness and elevated regulatory scrutiny.

The two are intertwined such that many early-stage companies are truly struggling to tackle these challenges. Whereas the neatly-capitalised Razorpay, Groww, and PhonePe are setting aside dollars to get the requisite regulatory clearances, it is a long way the early-stage ones which can moreover be suffering essentially the most.

Challenges in lending: “When the unicorns of nowadays had been at an early stage, they got a free pass in many areas. But for us, the initiation has been a trial by fireplace,” the founder of an early-stage fintech lending startup lamented.

His outfit became working as a loan aggregator in partnership with banks and mountainous NBFCs. The founder’s two-One year opinion became to scale up the industry and within the slay scout for an NBFC licence and fabricate his get loan book.

“After the digital lending guidelines came out it has turn out to be almost considerable for us to bag a licence. But getting an NBFC licence has been tricky for startups,” he said.

Honest now not too lengthy ago, neobanking startup Jupiter got an NBFC licence. After Cred and BharatPe every failed to contrivance the reduce, this became a undeniable signal. Per chance others can prevail as neatly.

As issues stand, it is no marvel that fintechs have been browsing spherical to build an NBFC licence. Cred obtained Parfait Finance in November 2021 and BharatPe obtained Trillionloans, a Mumbai-basically basically based NBFC, in March.

Stagnation in payments: The going has turn out to be more difficult for price companies, too. Gamers equivalent to Razorpay, Cashfree, PayU and Paytm have all been stopped from acquiring contemporary retailers. Razorpay and Cashfree are awaiting their final price aggregator licence. PayU and Paytm, within the meantime, have been requested to have a examine contemporary.

“We are hopeful that the closing clearance will reach along with a inexperienced signal for us to build contemporary retailers,” said a top executive at one amongst the major price companies.

This stop signal from the RBI has injure some of their fundraising plans, too. The executive quoted above added that if there’ll not be any progress in contemporary carrier provider onboarding, patrons is almost definitely now not enthused. Investors are awaiting the RBI’s final nod prior to cutting a cheque, he said.

The founder of one other payments startup said that earnings progress is heading within the appropriate direction for now, but when the RBI would now not birth contemporary carrier provider onboarding speedily, there shall be a fundamental affect on his firm’s earnings projections.

Regulatory flip flops: It’s now not repeatedly about strict regulatory scrutiny; typically, it’s also about regulatory flip flops. World payments companies met the solutions localisation guidelines by toeing the RBI line. But some of them have also been impacted by changing regulatory stances.

I wrote on April 24 about how Visa Safe Click became shut down by the firm after the regulator expressed unhappiness with the product. Merit in 2016, the RBI had allowed card-now not-contemporary (CNP) transactions up to Rs 2,000 to battle by with out a further recount of authentication. Aloof, Visa found itself non-compliant.

“Infrequently there would possibly perhaps be backdoor arm twisting from the regulator, which is putting in complications for even mountainous fintech companies,” said a senior executive at a global payments big. “A consistent contrivance from the RBI will abet.”

Honest now not too lengthy ago, the UK parliament, in a account on the India-UK Free Alternate Settlement, called the considerable files localisation requirements in India a stumbling block.

Because the fintech ecosystem matures, there would possibly perhaps be a necessity for sector regulators to scrutinise it extra. But extra scrutiny and licensing kills innovation and creates boundaries, combating others from coming into the home with disruptive solutions. If the regulators would actually like to retain the ecosystem birth, they ought to try to be gentle-contact with early-stage gamers and most likely stricter with the late-stage ones.

ETtech Exclusives

PhonePe would possibly perhaps perhaps well moreover simply waive off ZestMoney’s $18-mn debt: PhonePe and ZestMoney have now not parted methods fully, now not but. Sources told us PhonePe is end to signing a commercial diagram with ZestMoney wherein this can utilize the lending startup’s skills stack and would possibly perhaps perhaps rent some of its workers. The Walmart-owned payments major is determined to waive off the $18-million credit line it had equipped to the beleaguered lending startup in lieu of this licensing transaction.

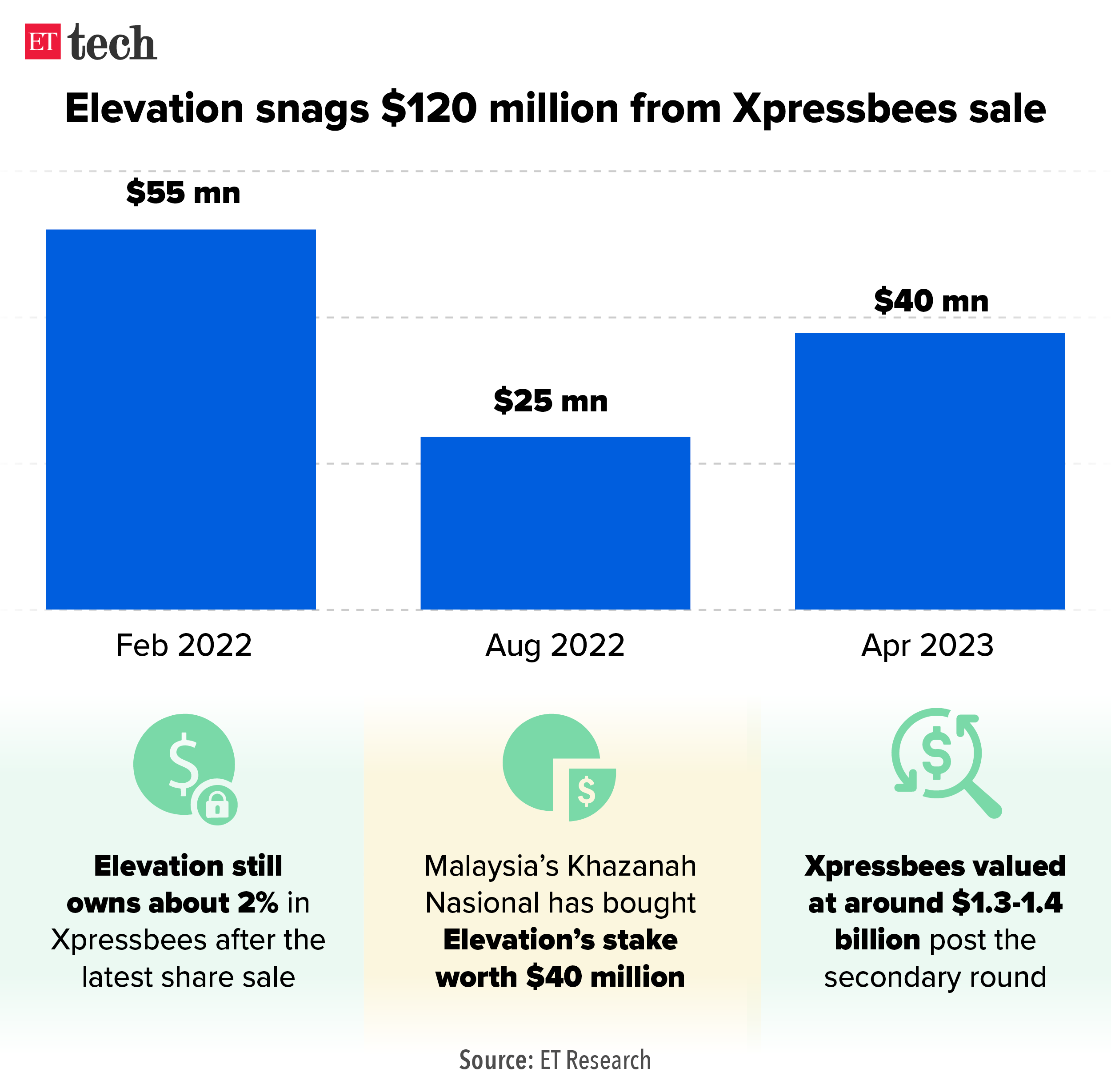

Elevation Capital sells $40-mn stake in Xpressbees to Malaysia’s Khazanah: Malaysia’s sovereign wealth fund Khazanah Nasional has picked up about 3% stake in ecommerce focussed logistics agency Xpressbees by paying $40 million by a secondary share sale, sources briefed on the topic said. Xpressbees has facilitated the funding spherical at a 25-35% top charge valuing it at spherical $1.3-1.4 billion.

Online stock brokers suffer major loss of lively users: Tech-backed bargain brokers which won immensely for the period of the pandemic have been hit staunch by the final One year. Tiger World-backed Upstox has viewed spherical 2 million merchants accelerate sluggish, whereas with regards to 200,000 merchants left Zerodha for the period of the identical time. Even 5Paisa lost 1 million users. Groww and AngelOne have bucked the pattern and have grown their lively trader injurious positively within the identical time body.

Neobank Jupiter secures NBFC licence: Neobanking startup Jupiter has secured a non-banking finance firm (NBFC) licence from the Reserve Financial institution of India (RBI), a construction that would possibly perhaps abet it dole out credit from its books. Jitendra Gupta, founder of Bengaluru-basically basically based Amica Financial Technologies Ltd., which runs the startup, told us Jupiter will rent a official chief executive officer to bustle the NBFC.

Startup Nook

Over 9,000 startup jobs slashed between Jan-March: As regards to 9,400 staffers across startups had been fired for the period of the first three months of this One year, per a account by recruitment platform Careernet shared completely with ETtech. Edtech companies including Byju’s and Unacademy, have fired the excellent numbers – over 1,000 workers at a time.

Most early-stage patrons demand muted 2023, says account: Over 80% of patrons within the early-stage startup ecosystem mediate that the investment process in 2023 shall be at a slower tempo than final One year, a account by challenge-debt agency InnoVen Capital said. For the account, the agency surveyed 20 early-stage patrons including Blume Ventures, WaterBridge Ventures, India Quotient, Kae Capital and others.

ETtech Interviews

‘We would actually like to get more product IPs, fabricate distribution chops’: Shiv Nadar, pioneer of the nation’s “startup and innovation” custom as he became the first to introduce microcomputers contrivance assist in 1978, spoke to us about what the Indian skills substitute ought to enact to give a boost to its product capabilities, make a sustainable custom for startups and his philanthropic imaginative and prescient. He became conferred the ET Company Excellence Award for Lifetime Fulfillment 2022-23.

Study the beefy interview right here

‘Emphasis on efficiency, trace optimisation in FY24’: As an uncertain market depresses discretionary spending, India’s third greatest tool companies agency, HCLTech, will within the immediate term traipse offers pushed by trace optimisation and vendor consolidation, its chief executive and managing director C Vijayakumar told us. He also spoke about alternatives within the banking sector even as there are considerations over the steadiness sheets of some smaller banks.

Study the beefy interview right here

Tech Policy

Adverts of having a bet, gambling sites aloof in play on social media: Online having a bet and gambling portals proceed to aggressively advertise on social media platforms no topic India’s contemporary gaming guidelines prohibiting having a bet and wagering of any form. This also areas these internet sites and companies in contravention of guidelines from the I&B ministry, directing media companies and online intermediaries to chorus from carrying commercials and promotional content material connected to having a bet platforms.

Startups name for exempting more from angel tax: The startup substitute is lobbying with the finance ministry to scrap, or at the least enlarge, the Rs 25-crore threshold below which it is exempted from the so-called angel tax. The synthetic says handiest a miniature percentage of startups shall be in a self-discipline to meet this limit. The Centre is gathering inputs from varied stakeholders and is anticipated to reach up with a detailed clarification on angel tax quickly.

Amendments to Aadhaar authentication guidelines ‘unconstitutional’, teach consultants: The proposed amendments to the Aadhaar Authentication for Staunch Governance (Social Welfare, Innovation, Files) Guidelines, 2020, (GG Guidelines) are unconstitutional and violative of the Supreme Court’s 2018 Aadhaar judgment, appropriate form consultants said, arguing that the adjustments would contrivance of us more inclined to frauds. The executive cannot overcome the Supreme Court judgment by amending the IT guidelines, said frail Supreme Court contemplate BN Srikrishna.

Visa pauses single-click checkout for Indian ecommerce transactions: Card payments major Visa has paused its single-click checkout carrier for online transactions in India, amid a push by the RBI to tighten security requirements for digital payments. In 2019, Visa launched ‘Visa Single Click’ in India to enable a mushy checkout for patrons procuring for goods online price up to Rs 2,000. This function did now not need CVV or OTP to be punched in whereas making a transaction.

Google’s Merely Troubles

Madras HC restrains Google from ejecting Bharat Matrimony app from Play Store: Google and Matrimony.com remain sure together for now. Granting an intervening time injunction in a case filed in opposition to the tech big by Matrimony.com, the Madras High Court directed the frail to now not delist the Indian platform’s app from its Play Store unless June 1. Matrimony.com had approached the court docket alleging Google became forcing app builders to undertake its person-need billing gadget.

HC points notices on Google’s plea in opposition to ADIF squawk: A division bench of the Delhi High Court issued notices to an alliance of Indian startups and the Competition Commission of India (CCI), looking out out their response to Google’s enchantment in opposition to an squawk directing the antitrust watchdog to absorb complaints in opposition to the tech big’s contemporary in-app aquire billing gadget. Google had approached the division bench on Tuesday.

IT Earnings Roundup

2.jpg)

Wipro experiences flat Q4 win profit; board approves Rs 12,000-crore share buyback: India’s fourth-greatest tool exporter Wipro on Thursday neglected estimates to account a flat fiscal fourth-quarter win profit whereas flagging uncertainties in skills spending, but the announcement of its 2nd buyback in as decades at a end to twenty% most top charge to the sizzling market trace would possibly perhaps perhaps well moreover cushion the predicted fall in stocks. Study the beefy earnings account right here

Tech Mahindra’s Q4 win profit dips 26% to Rs 1,118 crore: Tech Mahindra reported a 25.8% One year-on-One year dip in win profit for Q4 FY23, lacking estimates to Rs 1,118 crore due to cutdown in shopper spending and bigger employee prices. North American inflation has impacted spending sentiment, whereas Europe is also going by challenges, said CEO CP Gurnani. Study the beefy earnings account right here

LTIMindtree Q4 profit flat at Rs 1,114 crore; earnings jumps 22% YoY: LTIMindtree’s win profit grew 0.5% in Q4, lacking estimates. The subdued quantity came due to larger employee prices and other bills. The firm maintained a cautious tone about the keep a query to atmosphere and said that purchasers are focusing more on projects that lift in trace efficiencies. Study the beefy earnings account right here

Discussion about this post